Running a franchise is all about consistency and growth. But when you manage multiple locations, it can be challenging to see what’s working and where to improve. That’s where key performance indicators (KPIs) come in. The right KPIs give you visibility across every unit, helping you compare performance, identify trends, and make smarter business decisions.

At Ceterus, we make franchise bookkeeping faster, easier, and more accurate through automation and real-time benchmarking. Our platform automatically collects and organizes your financial data so you can track performance across every location, spot trends sooner, and make confident business decisions backed by data.

Why KPIs Matter for Franchise Owners

KPIs are the foundation of strong franchise management. They help owners understand where the business is thriving, where costs are rising, and how each unit compares to the rest of the system. Tracking these performance indicators consistently allows you to:

- Identify which locations are most profitable

- Spot cost trends before they affect margins

- Measure labor and marketing efficiency

- Decide when to scale, reinvest, or adjust strategy

With Ceterus Bookkeeping, franchise owners can see these metrics in real time, updated automatically, and organized by the brand-approved chart of accounts. No manual work, no outdated reports — just the data you need to grow.

Essential KPIs Every Franchise Should Track

Not every metric matters equally. The top-performing franchise owners focus on KPIs that connect directly to financial health and operational efficiency.

Start with these five essentials:

- Revenue per Unit: Identify high-performing locations and those that need extra support.

- Same-Store Sales Growth: Track long-term progress and overall brand health.

- Labor Cost as a % of Sales: Maintain profitability by balancing staffing levels with revenue.

- Operating Margin: Measures efficiency and overall financial performance.

- Customer Retention Rate: See whether your brand keeps customers coming back.

Because Ceterus Bookkeeping integrates directly with your POS, payroll, and bank accounts, these KPIs update automatically. Giving you consistent, compliant financials every month.

How to Use KPI Data Effectively

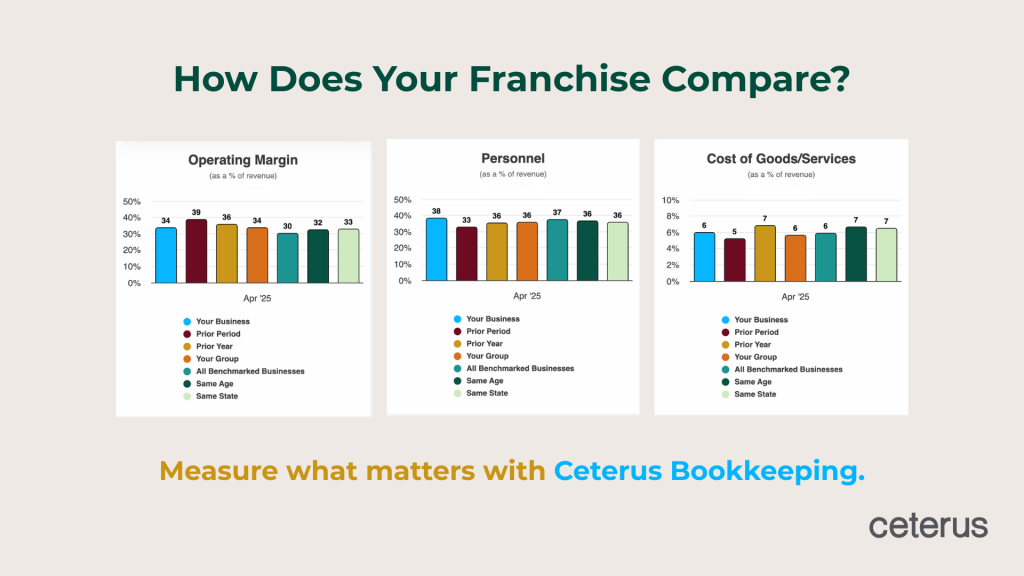

Tracking numbers is important, but the real advantage comes from understanding what they mean. Benchmarking your franchise data gives you context for smarter decision-making.

With Ceterus Benchmarking, franchise owners can compare unit performance against peers and brand averages, instantly seeing where each location stands. You’ll know whether your margins, labor costs, or revenue per unit are above or below the brand average — and exactly where to focus next.

Ask yourself:

- Is my location performing above or below the brand benchmark?

- Are my operating costs aligned with similar units?

- Where can I improve profitability without adding workload?

Ceterus turns those questions into clear, actionable insights.

Avoid These Common KPI Mistakes

- Tracking too many metrics that don’t drive growth

- Focusing on vanity metrics instead of financial performance

- Failing to track KPIs consistently across locations

By keeping your KPIs consistent and automating the data collection process with Ceterus, you’ll always have a reliable view of your franchise’s financial health.

Better Decisions Start with Better Data

Strong franchises are built on smart, data-driven decisions. With Ceterus Bookkeeping, franchise owners get automated bookkeeping, brand-compliant financial reporting, and built-in benchmarking. All in one platform.

You’ll save hours each month, reduce accounting costs, and gain the clarity to grow confidently across every location. Whether you’re managing two units or twenty, you’ll finally have a real-time view of your business performance across your entire franchise system.

Are you ready to see how your franchise compares?

Schedule a demo and get a sneak peek into your brand’s benchmarking data and how Ceterus can help you grow smarter.